This is a guide to using the Volmex perpetual futures on the BVIV Index (Bitcoin Volmex Implied Volatility) and EVIV Index (Ethereum Volmex) on the Base and Arbitrum testnets.

Volmex perpetual futures on the BVIV and EVIV Indices make pure volatility tradable in an intuitive format - a first-of-its-type product and game-changer for cryptocurrency derivatives.

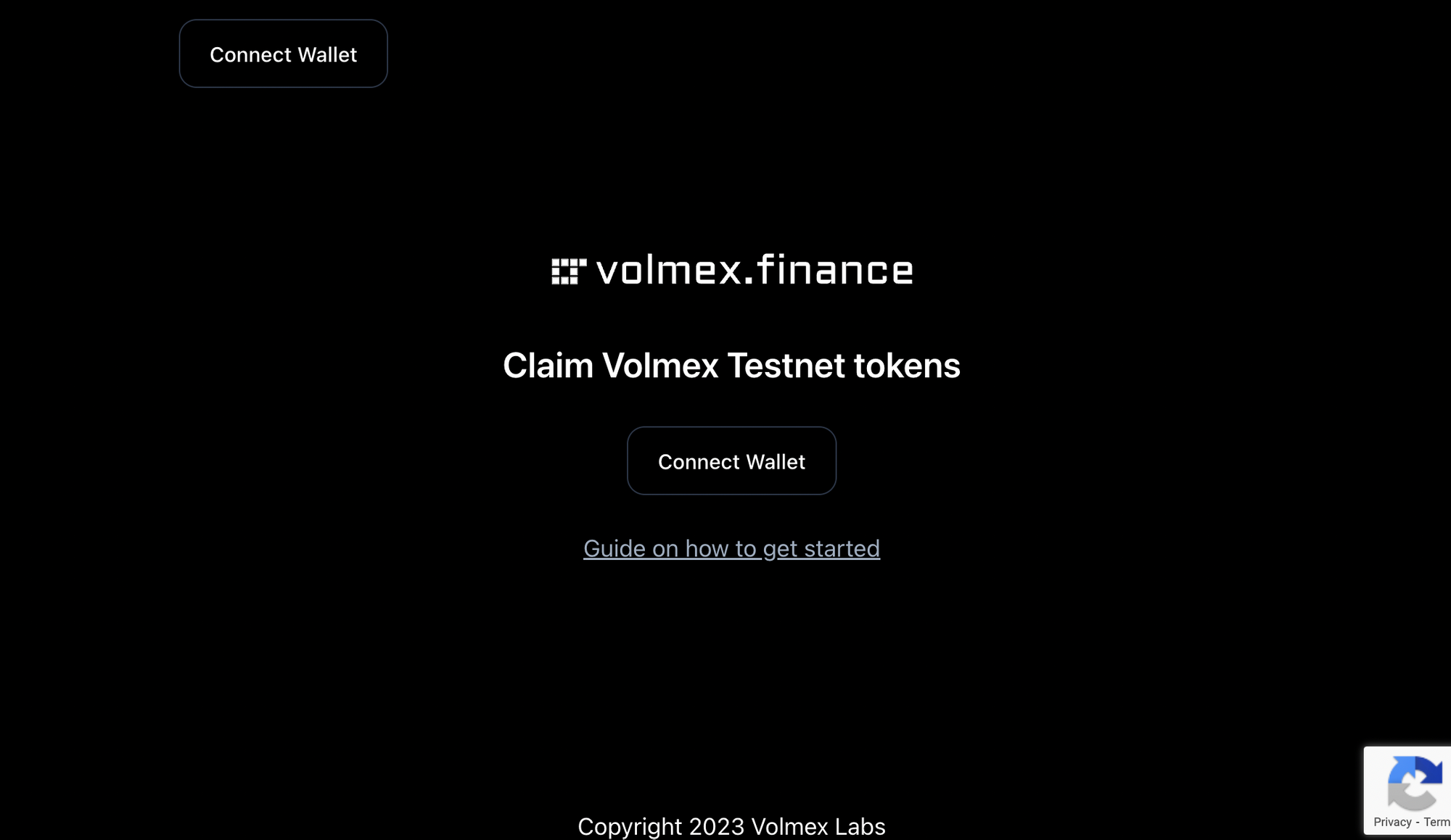

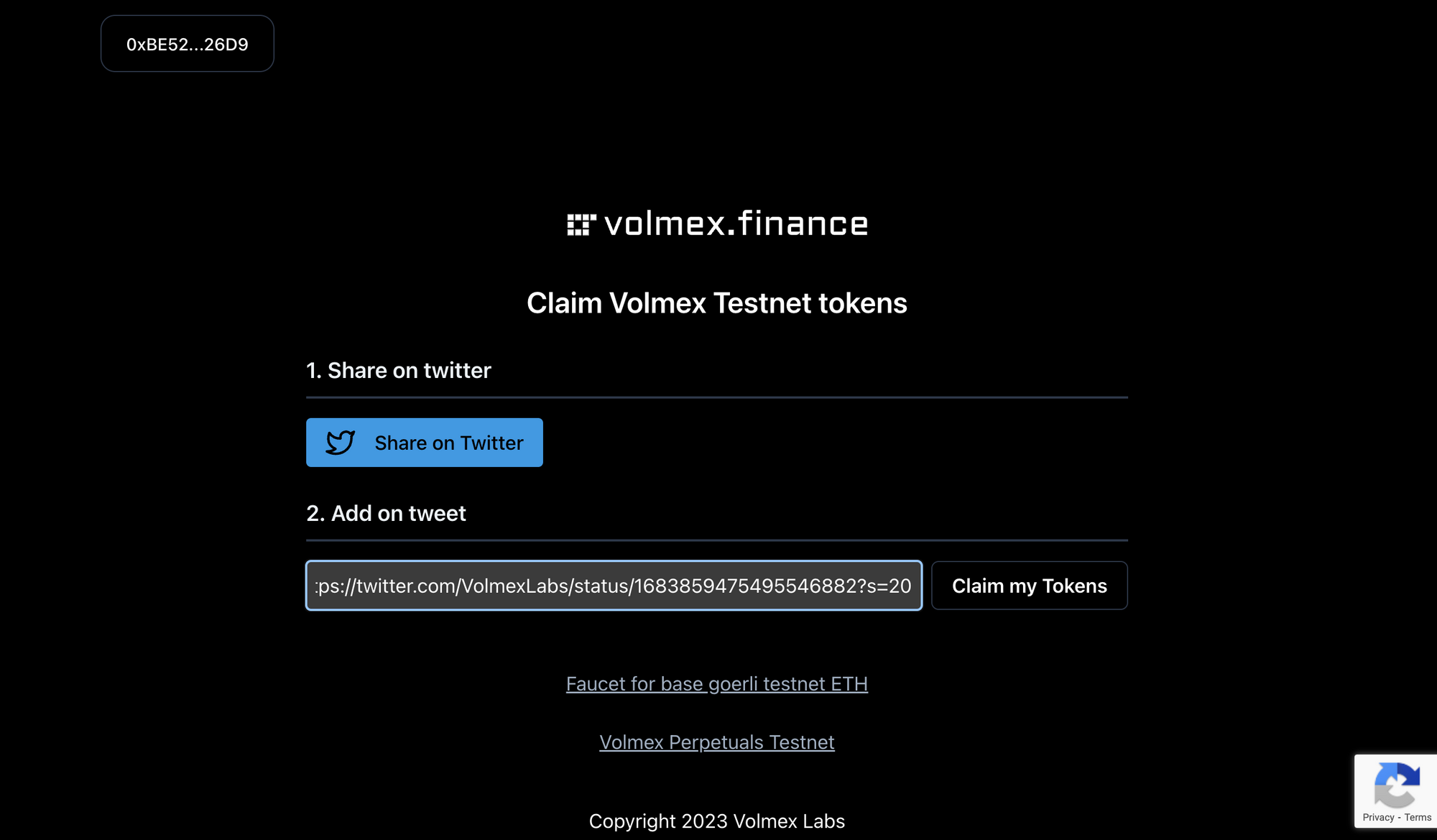

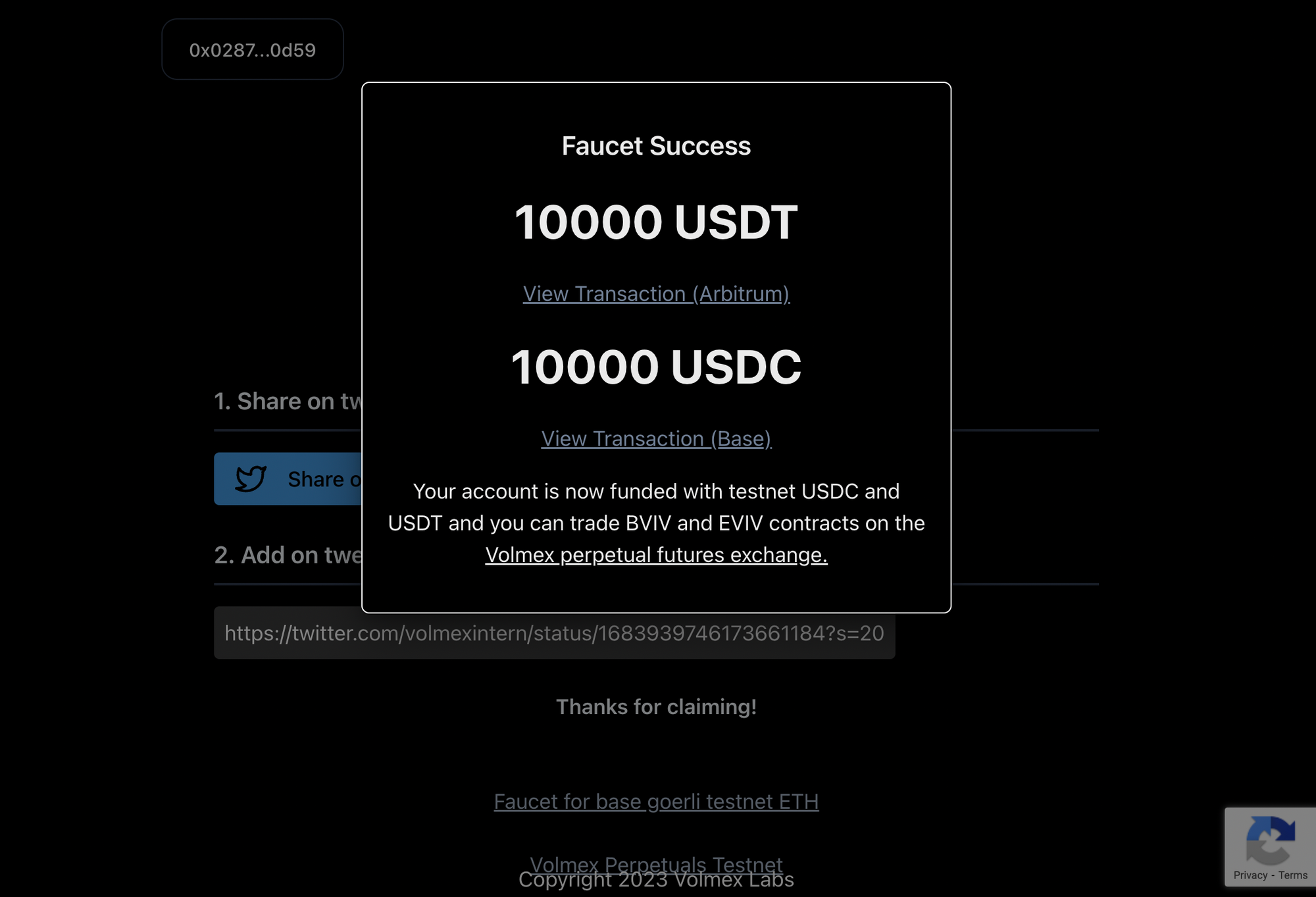

- Get testnet USDC and USDT on the Base and Arbitrum testnets by using https://faucet.volmex.finance/. Before claiming testnet tokens, you will need testnet Base Sepolia ETH (faucet) and Arbitrum Sepolia ETH (faucet). Connect wallet, tweet out the pre-populated tweet with your address, paste it, and you will receive tokens on both testnets.

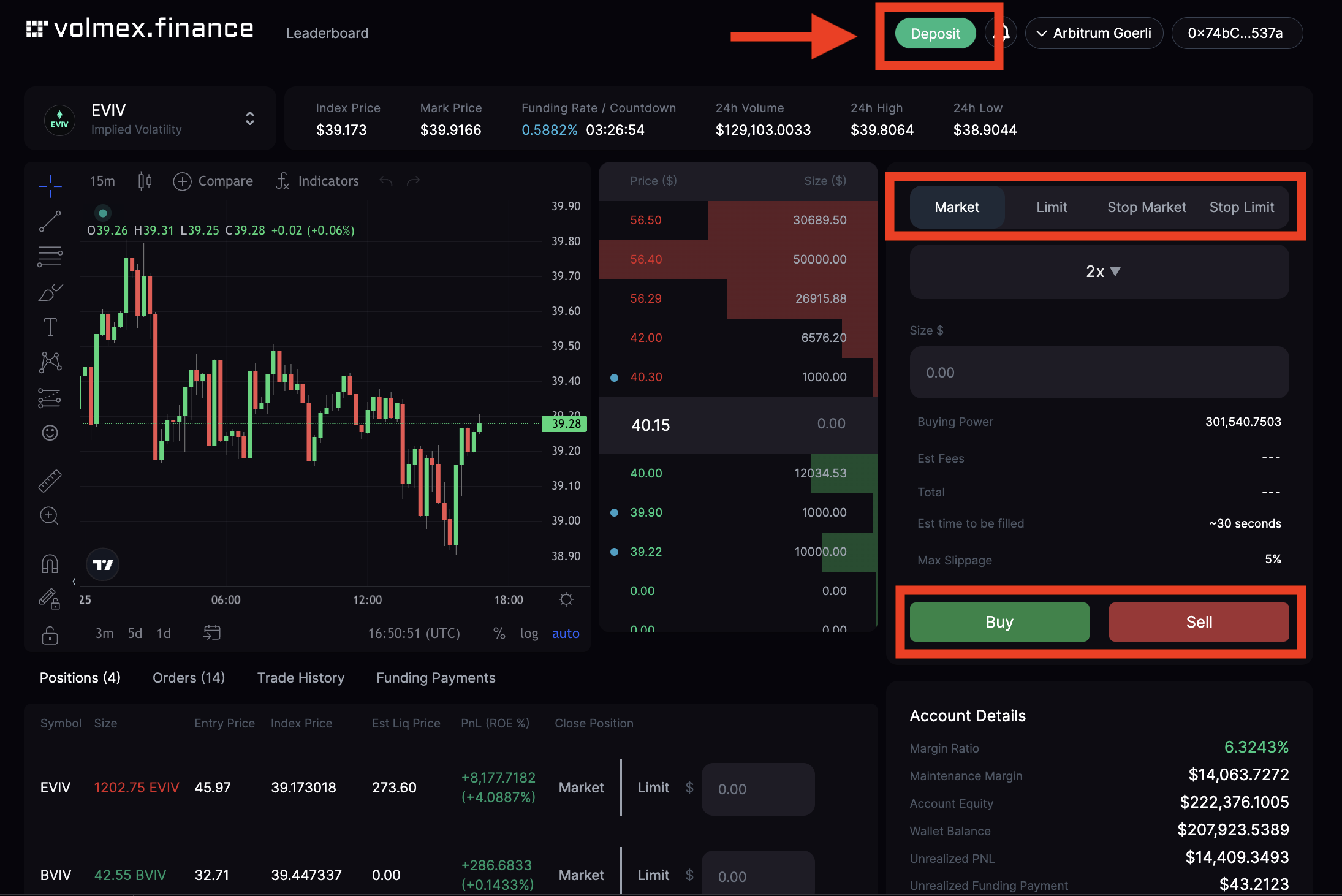

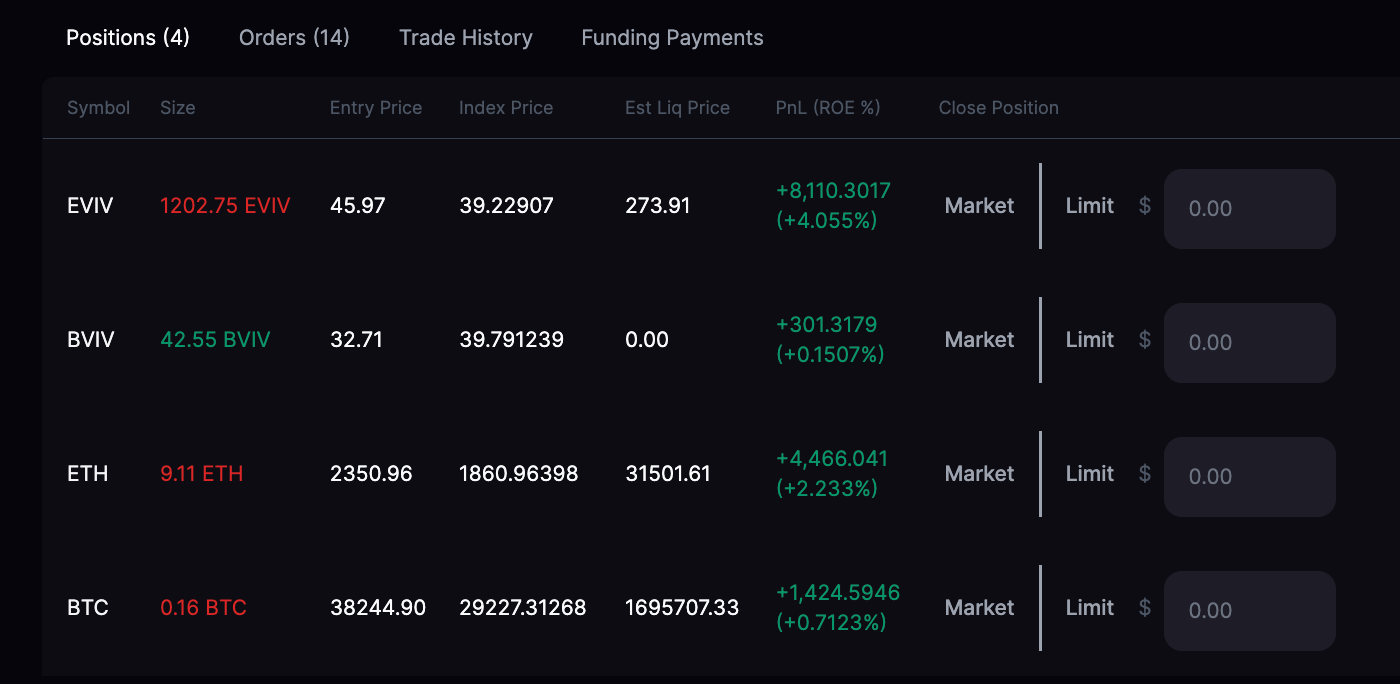

2. You are all set to trade BVIV and EVIV perpetual futures on the Base and Arbitrum testnets. Make sure you have the Base and Arbitrum testnets added to your Metamask. Deposit at https://perpetuals.volmex.finance/ and then begin trading.

Base Sepolia Testnet, RPC: https://sepolia.base.org, Chain ID: 84532

Arbitrum Sepolia Testnet, RPC: https://goerli-rollup.arbitrum.io/rpc, Chain ID: 421614

Read docs for more information: https://docs.volmex.finance/perpetuals/.

Participate in the trading competition now to win prizes! Learn more here.

More on Volmex

What are the Volmex Implied Volatility Indices, the BVIV Index and EVIV Index?

The Volmex Implied Volatility Indices (e.g. BVIV Index, EVIV Index, etc) are designed to measure the constant, 30-day expected volatility of the Bitcoin and Ethereum options market (and other assets in the future), derived from real-time crypto call and put options. Use the indices to track crypto volatility or trade linked derivatives.

Volmex charts: https://charts.volmex.finance/

Volmex methodology technical paper: https://volmex.finance/Volmex-IV-paper.pdf

How can Volmex perpetual futures be used?

BVIV and EVIV perpetual futures can be used to manage risk. BVIV and EVIV tend to be very negatively correlated during times of panic in the crypto market, making it a great tool to hedge or diversify. Additionally, BVIV and EVIV perpetual futures can also be used to speculate on implied volatility levels to generate alpha.

The BVIV and EVIV Indices are best-in-class volatility indices, which provide a reliable gauge for crypto market implied volatility.

More resources

FAQs: https://volmex.finance/

Volmex Twitter: https://twitter.com/volmexfinance

Volmex Discord community: https://discord.gg/volmex

Volmex charts: https://charts.volmex.finance/

Volmex Implied Volatility Index methodology technical paper: https://volmex.finance/Volmex-IV-paper.pdf