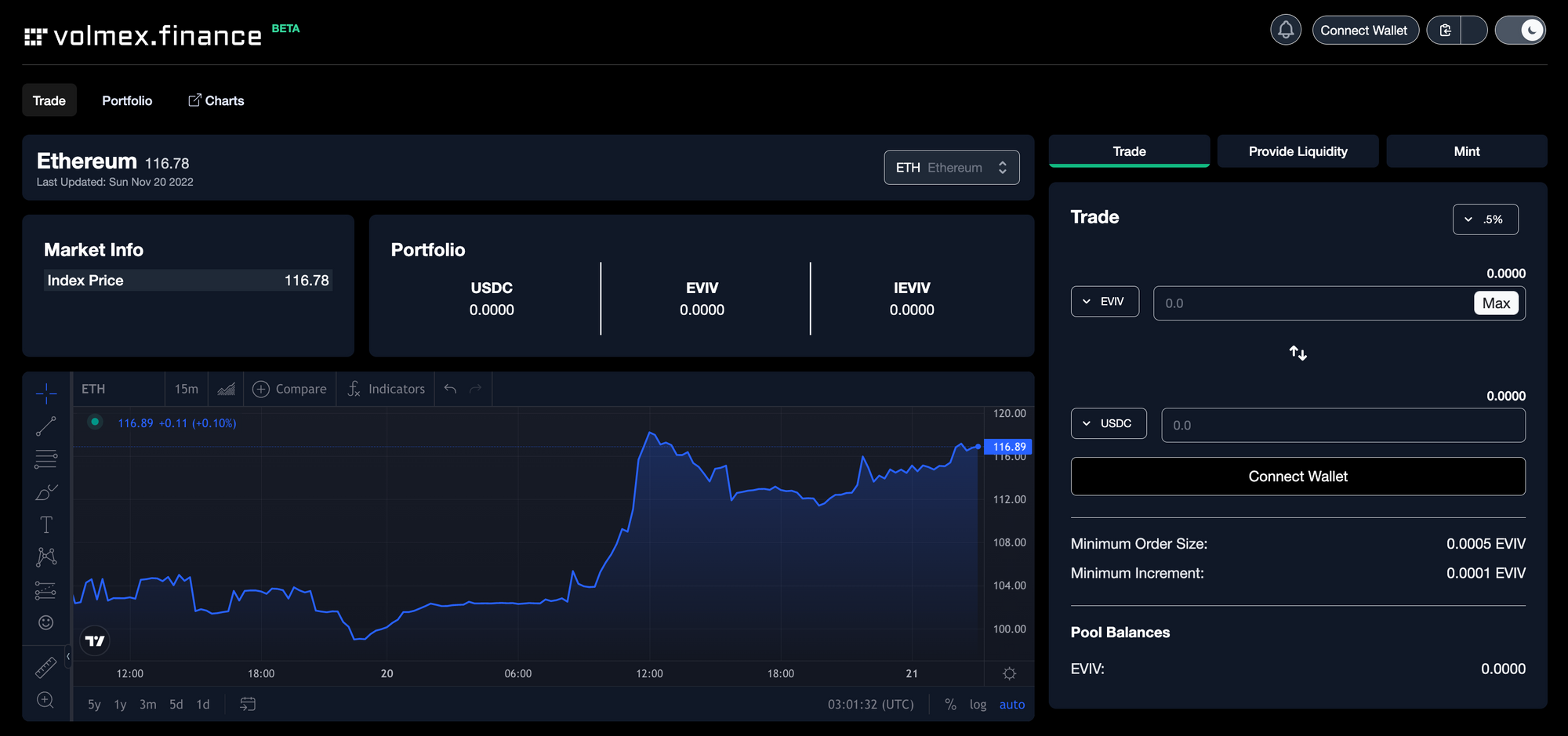

Volmex volatility Token v2 / AMM is now live on the Polygon mainnet! Volatility Token v2 / AMM is first BVIV and EVIV-linked derivative. As such, this is a major milestone for Volmex and the crypto industry.

The BVIV Index and EVIV Indices are designed to measure the constant, 30-day expected volatility of the Bitcoin and Ethereum options market (and other crypto assets in the future) respectively, derived from real-time crypto call and put options. Volatility tokens v2 / AMM make the BVIV and EVIV Indices tradable!

Volatility token v2 users

Volmex's volatility token v2 is a valuable tool. Who should be excited?

- Traders can hedge / manage risk, speculate, and diversify portfolio

- LPs can earn trading fees

- Builders can build products composing volatility tokens

How does Volmex's volatility token v2 and novel AMM work?

The Volmex AMM dynamically reprices volatility token liquidity to the Volmex volatility indices during material moves. Most AMMs use constant product formula. The Volmex volatility token AMM also uses the constant product formula, with the addition of the leverage coefficient. The leverage coefficient is used to alter the price of the tokens of a particular pool by using an external Oracle.

Traders can do swaps virtually at the current Volmex Implied Volatility Index level.

What will happen to volatility token v1?

A migration plan will be announced to migrate v1 to v2.

Docs: https://docs.volmex.finance/

Volatility Token v2 Paper: https://volmex.finance/vt2-AMM-paper.pdf

About Volmex

Volmex Labs is the leading builder of crypto volatility indices and products. Volmex is backed by leading crypto investors and traders including Robot Ventures, CMS Holdings, Orthogonal Trading, and more. The Volmex Labs team consists of world-class talent from various crypto and TradFi companies including Staked, IMC Trading, ConsenSys, and more.