The founding vision of Solana was NASDAQ onchain, yet, until now, it never had a single, trusted yardstick for the cost of capital. Today, Volmex is thrilled to roll out the Solana Volmex Prime Rate Index (SVPR), the definitive benchmark for Solana’s cost of capital. SVPR distills on-chain USD-stablecoin borrowing activity and SOL perpetual futures funding into one transparent, market-driven rate, giving builders, traders, and treasuries a clear north-star for pricing risk on Solana.

Disparate lending APYs and perpetual funding rates across exchanges obscure true funding costs. By delivering a single, intuitive benchmark for SOL interest rates, SVPR filters out the noise, letting the market converge on a clear fair rate. Volmex’s SVPR Indices update in real-time, setting the table for yield product innovation on a chain optimized for speed and composability. Solana moves fast. Now its benchmark rates do too.

Historically, trading desks have pieced together APYs from disparate protocols, while perps traders eyeballed funding prints on disparate exchanges. SVPR fixes this issue. The Solana Volmex Prime Rate Index is the first unified benchmark for Solana credit.

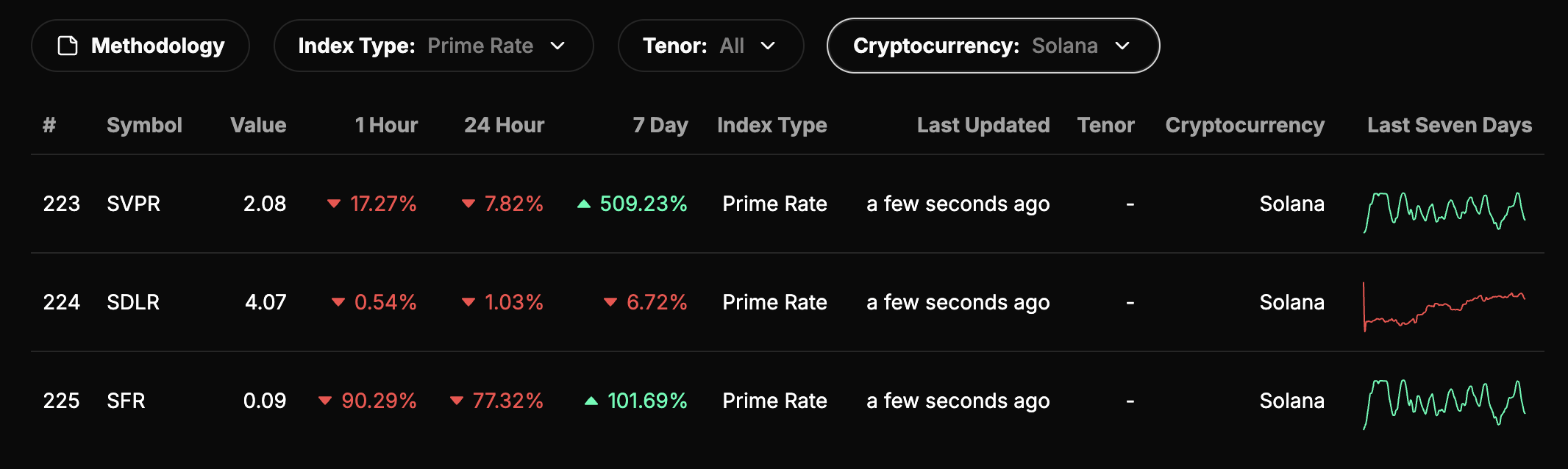

SVPR is built on two complementary components:

• Solana Volmex DeFi Lending Rate (SDLR) Index: Gauge liquidity and sentiment by tracking lending dynamics on Solana. At launch we’re pulling data from @KaminoFinance, @save_finance, and @DriftProtocol

• Solana Funding Rate Index (SFR) Index: SOL perpetual-swap funding across leading venues.

SVPR: https://charts.volmex.finance/symbol/SVPR

SDLR: https://charts.volmex.finance/symbol/SDLR

SFR: https://charts.volmex.finance/symbol/SFR

Volmex Index Charts: https://charts.volmex.finance

Methodology: https://volmex.finance/VPR-paper.pdf

Volmex API: https://charts.volmex.finance/API-pricing