Today, Volmex Labs is excited to introduce two new additions to the Volmex index family: the MVIV Index and Term Structures.

MVIV Index (Market Volmex Implied Volatility)

Introduces an easily replicable portfolio of tradable implied volatilities of major cryptocurrencies. It uses individual implied volatilities with weights based on underlying asset market capitalization, utilizing the BVIV and EVIV Indices.

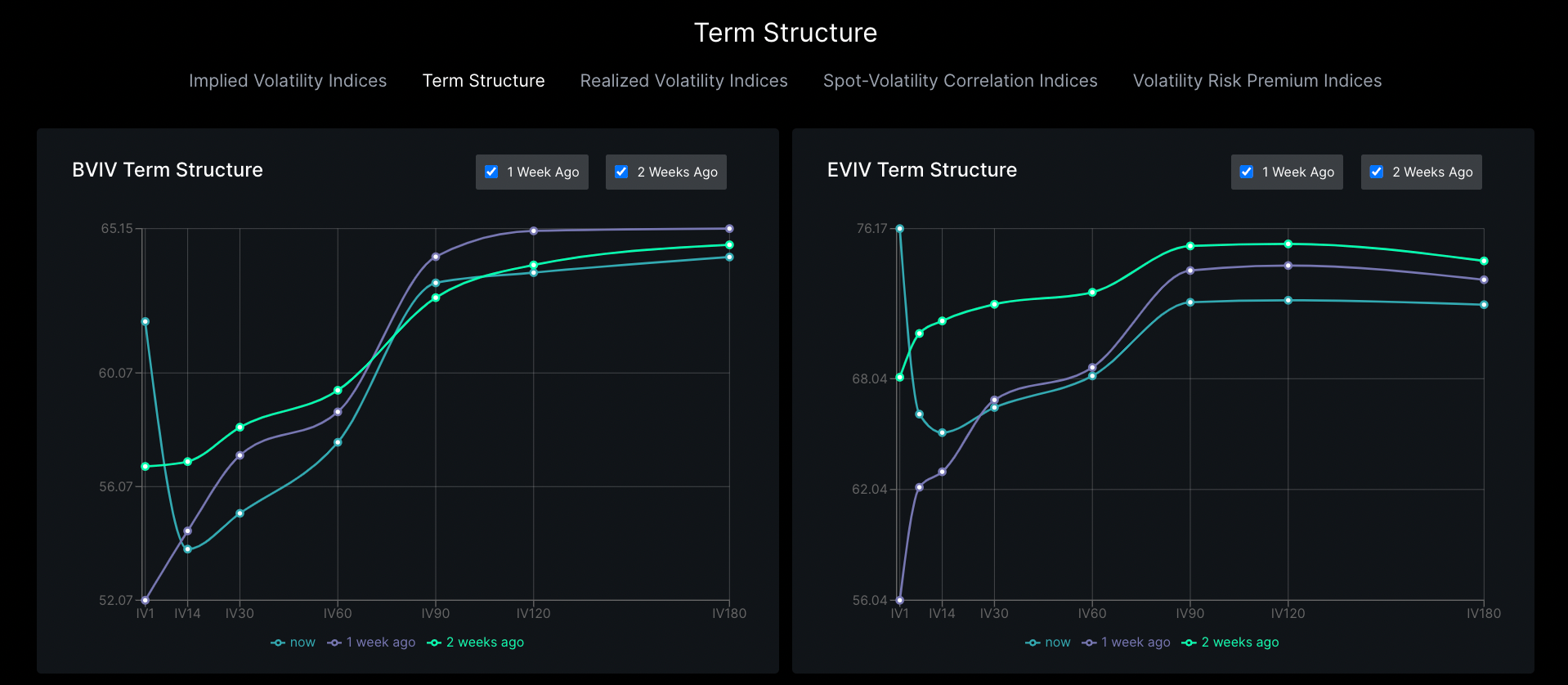

Term Structures

The Volmex Implied Volatility Indices (BVIV and EVIV) term structures measure the constant 1-day, 7-day, 14-day, 30-day, 60-day, 90-day, and 180-day expected volatility of the Bitcoin and Ethereum options market.

Access here: https://charts.volmex.finance

Learn more about Volmex:

Volmex Implied Volatility Indices, notably the BVIV Index (Bitcoin Volmex Implied Volatility) and EVIV Index (Ethereum Volmex Implied Volatility), are a series of indices created by Volmex Finance that track the forward-looking 30-day volatility implied by the option quotes available on leading options exchanges. The BVIV and EVIV Indices are both a single number that summarizes the market expectations on BTC and ETH’s future moves. Volmex volatility indices are supported by industry leaders including TradingView, CoinMarketCap, and more.

- Website: https://volmex.finance

- Charts: https://charts.volmex.finance

- Volmex Methodology Paper: https://volmex.finance/Volmex-IV-paper.pdf

- BVIV on TradingView: https://www.tradingview.com/symbols/BVIV

- EVIV on TradingView: https://www.tradingview.com/symbols/EVIV

- BVIV-PERP on Bitfinex: https://trading.bitfinex.com/t/BVIVF0:USTF0

- EVIV-PERP on Bitfinex: https://trading.bitfinex.com/t/EVIVF0:USTF0